Benefits of account aggregator framework

Account Aggregator: A Game-changer for Financial Inclusion

The financial sector is buzzing with hype about the revolutionary potential of Account Aggregator (AA). The framework will have a transformative effect on the financial services ecosystem and could become the next UPI moment for lending. AA is expected to revolutionise lending, wealth management, and financial planning in the coming years.

Customers’ financial data, such as bank accounts, mutual fund investments, insurance, and pension funds, are spread across various banks and other financial entities. Each service provider has different processes, logins, and platforms to access the account information.

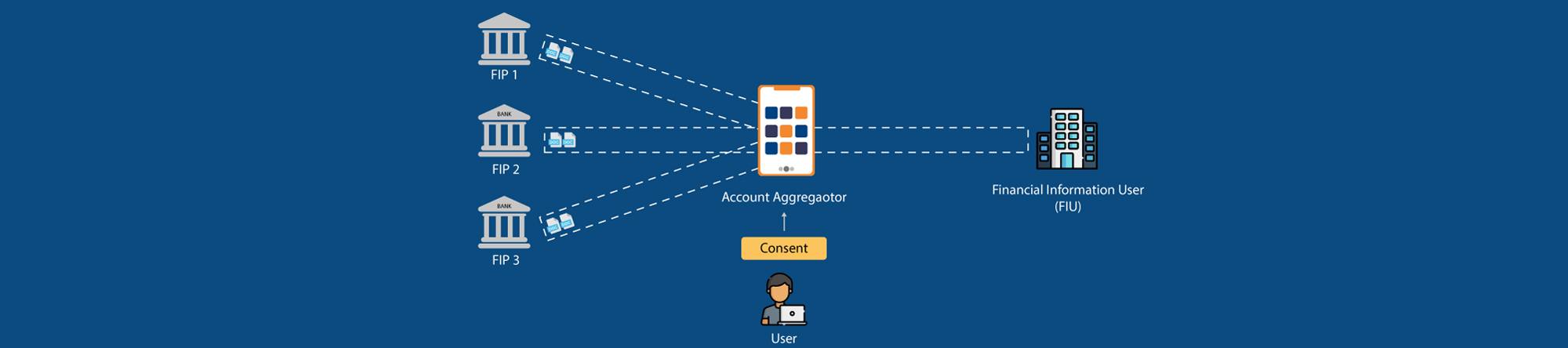

Account aggregation aims to solve this issue by collating customers’ financial data from multiple sources under one roof. It aggregates data from financial institution providers (FIPs) and presents it to Financial Information Users (FIUs). AA will pave the way for lending agencies to assess their customers’ creditworthiness better and de-risk their loan books by anticipating NPAs. This brings us to the Account Aggregator framework.

Account Aggregator Framework

An Account Aggregator is a digital platform that helps you securely share your financial data from your account with any other financial institution that needs this information to serve you. An Account Aggregator acts as a digital conduit to transmit user financial information; however, it does not manage or store this data. AA is ‘data-blind’ as the data that flows through an AA is encrypted. It does not store any user’s financial information, thus prevents from potential leakage and misuse by the Account Aggregator.

Key Players in the AA Ecosystem:

- Financial Information Provider (FIP) is a regulated authorised entity that holds customers’ financial data and shares it with FIU through an account aggregator. They are banks, banking companies, non-banking financial companies, asset management companies, depository, depository participants, insurance companies, insurance repositories, pension funds, and other entities that the bank may identify for the purposes of these directions from time to time.

- FIU stands for “Financial Information User.” An entity registered with and regulated by any financial sector regulator. An FIU consumes the data from a FIP to provide various services to the end consumer.

- Technology Service Providers (TSPs) collaborate with FIPs and FIUs to deliver AA-enabled products and services. Using the Account Aggregator framework, they develop modules to obtain a customer’s financial information (including bank statement information) directly from the banks (through APIs).

To better understand the distinction between these two entities, imagine applying for a loan with Bank “A”. Bank A requires your financial information, such as the statement of your savings bank account held with Bank “B”, to evaluate your loan application and assess your creditworthiness. In this case, Bank B becomes the FIP, and Bank A is the FIU. The AA ecosystem includes banks, insurance agencies, mutual fund companies, asset/wealth management firms, pension funds, and regulatory bodies.

The Account Aggregator ecosystem aims to democratise data access, empower consumers with complete control of their sensitive financial information, and speed up the sharing of information between FIPs and FIUs while minimising the risk of fraud.

Of course, the consumer chooses what information to share with whom, and none of this data can change hands without explicit consent that can be denied or revoked at any time. The framework can potentially democratise financial services distribution and make it easier to evaluate and underwrite new-to-credit and underbanked borrowers.

How the Account Aggregator Ecosystem Will Help Underserved Customers and Lenders

Empowering Financial Inclusion and Alternate Data Collection for Digital Lending:

AA will play a pivotal role in laying the groundwork to move from asset-backed lending to cash-flow-based lending. This can enable them to serve individuals and MSMEs previously untapped or underserved by financial services.

For consumers, alternative data provides two distinctive advantages:

- More potential borrowers will be able to secure a loan, including many from among today’s credit-invisible and underbanked borrowers.

- Borrowers will have access to lower interest rates.

For lenders, the key benefit of alternative data is the increased number of profitable loans to be made consistent. Another additional benefit could be a reduction in transaction costs and manual processes.

Bridging the Financial Literacy Disparity:

Technological advancements like the Account Aggregator boost financial literacy among customers, helping them better understand the results of their financial decisions and actions. The framework can improve the efficiency of financial services driving toward financial inclusion in the country.

Way Forward

AA will make credit risk evaluation easier, economical, and accessible. The framework will ensure the availability of credit on an extensive scale. As more users join this ecosystem, new use cases will emerge.

How CRIF Connect Can Help

CRIF Connect is an RBI-licensed NBFC Account Aggregator. It allows you to aggregate and view all your assets in one platform. This platform enables the simple and safe exchange of your data between financial institutions like banks, mutual fund companies, insurance agencies, or other regulatory bodies.

CRIF connect accomplishes this by offering users a secure end-to-end encrypted data-sharing platform that retrieves and provides financial data from one financial entity to another without ever reading, storing, or using it.

- The data is shared only with your permission.

- You can view the reason and duration of data requests and approve or deny these requests.

- Consents can be paused or revoked at any time using the CRIF Connect app or website.

Reach out to learn more about how CRIF Connect can empower you to share and control your financial data securely.